Overdrafts aren’t something we plan for nor is it a transaction that we’d ever willingly do. However, life being what it is and bills being what they are, they sometimes can’t be avoided.

While we aren’t keen on instant overdrafts, it’s still good to have a fallback when we’re strapped for cash. It’s therefore useful to know which online banks allow overdrafts instantly so you can get cash right away.

In this article, we list eight banks that let you overdraft immediately. Let’s get started.

Chime Overdraft – $200 free

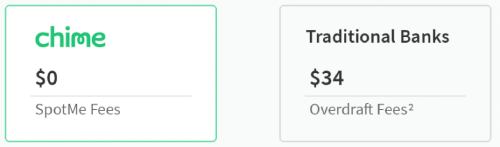

Chime offers a program called SpotMe that offers an instant bank overdraft limit of up to $200 without overdraft fees. Unlike traditional overdraft protection, qualifying Chime members won’t have to worry about overdraft fees when they’re in need of extra cash.

To be eligible for Chime’s SpotMe program, you’ll need to open a bank account with them and receive deposits worth $200 from the last 34 days. As long as you continue to actively loose your chime account you can continue using SpotMe.

SpotMe only covers debit transactions and cash withdrawals.

PNC Bank Overdraft

PNC Bank approves overdrafts on a case-to-case basis. Even if you enrolled for overdraft coverage, PNC will not automatically approve them. This means that you can’t expect to withdraw an extra $30 from the ATM any time you want.

Though approval isn’t guaranteed, PNC Bank offers overdraft coverage for check transactions, automated bill payments, and payments from your checking account that use your bank account number.

Whether your overdraft has been accepted or declined, PNC charges a $36 overdraft fee and a maximum of $144 or four overdraft fees per day. If your account remains flagged for over five days straight, you’ll also be charged up to $98 or $7 each day for 14 days.

Wells Fargo Overdraft

Wells Fargo operates somewhat similarly to PNC Bank in the sense that it doesn’t approve overdraft ATM and debit transactions. Unlike PNC though, the bank doesn’t charge a fee if an overdraft is declined.

Instead, it approves checks and recurring bills on a case-to-case basis. The bank typically charges $15 as an overdraft fee with which can be charged a maximum of twice per business day. There is also a larger $35 fee for returning items for non-sufficient funds (NSF) which can be charged up to three times per business day.

If the bank decides to fund your overdraft with money from a linked bank account, you’ll pay an additional $12.50 as a transfer fee. If the funds are taken from your credit account, you’ll need to pay interest rates too.

Bank of America (BOA) Overdraft

Bank of America (BOA) covers overdrafts for checking transactions, recurring debit transactions, and bills as well as Automated Clearing House (ACH) transactions. Unlike the previous banks mentioned, it also covers everyday debit transactions as well as ATM withdrawals, giving you better access to extra cash almost any time you need it.

Bank of America charges a $35 overdraft fee for overdrafts that are over a dollar and has a bank overdraft limit of four. Overdrafts amounting to less than a dollar are not charged any fees. However, Bank of America may charge more than one fee such as:

- An overdraft protection transfer fee of $12 instead of $35 if you’re enrolled for overdraft protection

- An NSF/returned item fee of $35 for every declined overdraft transaction

TD Bank Overdraft

Like Bank of America, TD applies a minimum overdraft spend of $10 before any fees are incurred. Any overdraft charge below that and you won’t need to pay the standard $35 overdraft fee.

TD Bank also approved overdrafts on a case-to-case basis. This includes recurring payments, checking accounts, ACH transactions, and even one-time ATM withdrawals and debit charges.

Chase Overdraft

There are three overdraft services offered by Chase:

- Standard Overdraft Practice covers checks and automated bills. A $34 fee is incurred if your account is overdrawn by more than $50 a day. Otherwise, you won’t have to pay the fee.

- Overdraft Protection links your checking account to a savings account as a backup. If your checking account can’t cover the required amount, money is transferred from your linked savings account to cover the cost. With this option, you can be approved for non-recurring debit transactions.

- Debit Card Coverage operates similarly to the Standard Overdraft Practice with the same fees. With this option, however, everyday debit transactions can also be approved.

BB&T Bank

BB&T Bank lets you have up to six overdrafts a day. However, they also have higher overdraft fees. The bank charges $36 per transaction and a maximum charge of $216 a day if you hit your limit.

BB&T also doesn’t normally authorize daily debit and ATM withdrawals unless you opt into the service.

SunTrust Bank

SunTrust waives overdraft charges if funds are deposited or returned within the daily cutoff. Charges can cost you as much as $36 per transaction while approval varies on a case-to-case basis.

SunTrust is a bit lenient when it comes to ATM withdrawals and daily debit card transactions. Furthermore, overdraft fees are also waived if your overdraft is under $5.

Risks Involved With Overdraft

As you know by now, overdrafts cost a lot of money. With some banks charging up to $36 per transaction, you might quickly go into debt if you have frequent overdrafts. Furthermore, there are other charges that you need to be aware of such as NSF fees or returned item fees, extended overdraft fees, transfer fees, interest charges, and overdraft protection fees that drive the cost even higher.

If you applied for overdraft savings protection, you may not realize that you’ve used up all your hard-earned money.

You should also keep in mind that not every bank will automatically approve an overdraft even if you’ve applied for overdraft coverage.

Do Overdraft Fees Affect Your Credit?

As long as you pay your overdrafts on time, you shouldn’t have anything to worry about. However, if you continuously miss payments on your overdrafts, then the bank may enlist the help of a collections agency that might report your financial activity to credit bureaus.

Alternatives to Overdrafting

If you’re short on cash, there may be better alternatives that can provide you with short-term liquidity such as bank loans, using a pay later apps or credit cards, and private lending firms.

Like anything financial, however, each has its own limitations and advantages so it pays to familiarize yourself with the terms and the fine print of each one before engaging their services.

Options For Bad Credit ($500 – $10,000)

If you’re looking for a bank account with overdraft for bad credit then you may want to look into a bad credit loan. A bad credit load can be a quick way to get cash. It may not be as instant as an overdraft but you can choose to access larger amounts than are typically available through an overdraft.

The most important thing to remember is that you will pay interest on any form of loan. Before agreeing make sure you understand your repayment terms and how much you will be paying in total.

Final Thoughts

While regular overdrafts aren’t a sound financial practice, it’s certainly handy to have some backup when you need it. If you absolutely must make use of it, pick a bank that doesn’t charge hefty fees and familiarize yourself with the terms and conditions of each one so you can avoid additional charges.